ligoniel homes ltd Company Information

Company Number

NI649690

Website

-Registered Address

46 hill street, belfast, county antrim, BT1 2LB

Industry

Construction of domestic buildings

Telephone

-

Next Accounts Due

March 2025

Group Structure

View All

Directors

Bryan Orr5 Years

Shareholders

bryan orr 100%

ligoniel homes ltd Estimated Valuation

Pomanda estimates the enterprise value of LIGONIEL HOMES LTD at £281.1k based on a Turnover of £976k and 0.29x industry multiple (adjusted for size and gross margin).

ligoniel homes ltd Estimated Valuation

Pomanda estimates the enterprise value of LIGONIEL HOMES LTD at £61.2k based on an EBITDA of £26.2k and a 2.33x industry multiple (adjusted for size and gross margin).

ligoniel homes ltd Estimated Valuation

Pomanda estimates the enterprise value of LIGONIEL HOMES LTD at £492.2k based on Net Assets of £390.6k and 1.26x industry multiple (adjusted for liquidity).

Edit your figures and get a professional valuation report.

Ligoniel Homes Ltd AI Business Plan

In just minutes, we combine Pomanda’s company and industry data with cutting edge Artificial Intelligence to build a comprehensive 27 section business plan. You then have 60 days to tailor the information, decide which sections to include or exclude, and add your own branding logos, images and color scheme to create your perfect plan.

Ligoniel Homes Ltd Overview

Ligoniel Homes Ltd is a live company located in county antrim, BT1 2LB with a Companies House number of NI649690. It operates in the construction of domestic buildings sector, SIC Code 41202. Founded in December 2017, it's largest shareholder is bryan orr with a 100% stake. Ligoniel Homes Ltd is a young, small sized company, Pomanda has estimated its turnover at £976k with declining growth in recent years.

Upgrade for unlimited company reports & a free credit check

Ligoniel Homes Ltd Health Check

Pomanda's financial health check has awarded Ligoniel Homes Ltd a 3 rating. We use a traffic light system to show it exceeds the industry average on 3 measures and has 6 areas for improvement. Company Health Check FAQs

3 Strong

1 Regular

6 Weak

Size

annual sales of £976k, make it larger than the average company (£436.8k)

- Ligoniel Homes Ltd

£436.8k - Industry AVG

Growth

3 year (CAGR) sales growth of -14%, show it is growing at a slower rate (7.6%)

- Ligoniel Homes Ltd

7.6% - Industry AVG

Production

with a gross margin of 10.2%, this company has a higher cost of product (21.1%)

- Ligoniel Homes Ltd

21.1% - Industry AVG

Profitability

an operating margin of 2.7% make it less profitable than the average company (5.4%)

- Ligoniel Homes Ltd

5.4% - Industry AVG

Employees

with 2 employees, this is below the industry average (3)

- Ligoniel Homes Ltd

3 - Industry AVG

Pay Structure

on an average salary of £43.4k, the company has an equivalent pay structure (£43.4k)

- Ligoniel Homes Ltd

£43.4k - Industry AVG

Efficiency

resulting in sales per employee of £488k, this is more efficient (£197k)

- Ligoniel Homes Ltd

£197k - Industry AVG

Debtor Days

it gets paid by customers after 147 days, this is later than average (22 days)

- Ligoniel Homes Ltd

22 days - Industry AVG

Creditor Days

its suppliers are paid after 2 days, this is quicker than average (30 days)

- Ligoniel Homes Ltd

30 days - Industry AVG

Stock Days

There is insufficient data available for this Key Performance Indicator!

- Ligoniel Homes Ltd

- - Industry AVG

Cash Balance

There is insufficient data available for this Key Performance Indicator!

- - Ligoniel Homes Ltd

- - Industry AVG

Debt Level

it has a ratio of liabilities to total assets of 1.3%, this is a lower level of debt than the average (72%)

1.3% - Ligoniel Homes Ltd

72% - Industry AVG

ligoniel homes ltd Credit Report and Business Information

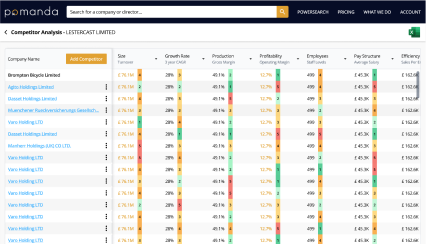

Ligoniel Homes Ltd Competitor Analysis

Perform a competitor analysis for ligoniel homes ltd by selecting its closest rivals and benchmarking them against 12 key performance metrics.

ligoniel homes ltd Ownership

LIGONIEL HOMES LTD group structure

Ligoniel Homes Ltd has no subsidiary companies.

Ultimate parent company

LIGONIEL HOMES LTD

NI649690

ligoniel homes ltd directors

Ligoniel Homes Ltd currently has 1 director, Mr Bryan Orr serving since Mar 2019.

| officer | country | age | start | end | role |

|---|---|---|---|---|---|

| Mr Bryan Orr | Northern Ireland | 61 years | Mar 2019 | - | Director |

LIGONIEL HOMES LTD financials

Ligoniel Homes Ltd's latest turnover from June 2023 is estimated at £976 thousand and the company has net assets of £390.6 thousand. According to their latest financial statements, we estimate that Ligoniel Homes Ltd has 2 employees and maintains cash reserves of 0 as reported in the balance sheet.

Data source: Companies House, Pomanda Estimates

| Jun 2023 | Jun 2022 | Jun 2021 | Jun 2020 | Dec 2018 | |

|---|---|---|---|---|---|

| Turnover | |||||

| Other Income Or Grants | |||||

| Cost Of Sales | |||||

| Gross Profit | |||||

| Admin Expenses | |||||

| Operating Profit | |||||

| Interest Payable | |||||

| Interest Receivable | |||||

| Pre-Tax Profit | |||||

| Tax | |||||

| Profit After Tax | |||||

| Dividends Paid | |||||

| Retained Profit | |||||

| Employee Costs | |||||

| Number Of Employees | |||||

| EBITDA* |

* Earnings Before Interest, Tax, Depreciation and Amortisation

| Jun 2023 | Jun 2022 | Jun 2021 | Jun 2020 | Dec 2018 | |

|---|---|---|---|---|---|

| Tangible Assets | 0 | 0 | 0 | 0 | 0 |

| Intangible Assets | 0 | 0 | 0 | 0 | 0 |

| Investments & Other | 0 | 0 | 0 | 0 | 0 |

| Debtors (Due After 1 year) | 0 | 0 | 0 | 0 | 0 |

| Total Fixed Assets | 0 | 0 | 0 | 0 | 0 |

| Stock & work in progress | 0 | 0 | 0 | 0 | 0 |

| Trade Debtors | 395,656 | 403,817 | 280,063 | 291,069 | 301,000 |

| Group Debtors | 0 | 0 | 0 | 0 | 0 |

| Misc Debtors | 0 | 0 | 0 | 0 | 0 |

| Cash | 0 | 0 | 0 | 0 | 0 |

| misc current assets | 0 | 0 | 0 | 0 | 0 |

| total current assets | 395,656 | 403,817 | 280,063 | 291,069 | 301,000 |

| total assets | 395,656 | 403,817 | 280,063 | 291,069 | 301,000 |

| Bank overdraft | 0 | 0 | 0 | 0 | 0 |

| Bank loan | 0 | 0 | 0 | 0 | 0 |

| Trade Creditors | 5,056 | 32,886 | 49,328 | 270,629 | 300,000 |

| Group/Directors Accounts | 0 | 0 | 0 | 0 | 0 |

| other short term finances | 0 | 0 | 0 | 0 | 0 |

| hp & lease commitments | 0 | 0 | 0 | 0 | 0 |

| other current liabilities | 0 | 0 | 0 | 0 | 0 |

| total current liabilities | 5,056 | 32,886 | 49,328 | 270,629 | 300,000 |

| loans | 0 | 0 | 0 | 0 | 0 |

| hp & lease commitments | 0 | 0 | 0 | 0 | 0 |

| Accruals and Deferred Income | 0 | 0 | 0 | 0 | 0 |

| other liabilities | 0 | 0 | 0 | 0 | 0 |

| provisions | 0 | 0 | 0 | 0 | 0 |

| total long term liabilities | 0 | 0 | 0 | 0 | 0 |

| total liabilities | 5,056 | 32,886 | 49,328 | 270,629 | 300,000 |

| net assets | 390,600 | 370,931 | 230,735 | 20,440 | 1,000 |

| total shareholders funds | 390,600 | 370,931 | 230,735 | 20,440 | 1,000 |

| Jun 2023 | Jun 2022 | Jun 2021 | Jun 2020 | Dec 2018 | |

|---|---|---|---|---|---|

| Operating Activities | |||||

| Operating Profit | |||||

| Depreciation | 0 | 0 | 0 | 0 | 0 |

| Amortisation | 0 | 0 | 0 | 0 | 0 |

| Tax | |||||

| Stock | 0 | 0 | 0 | 0 | 0 |

| Debtors | -8,161 | 123,754 | -11,006 | 291,069 | 301,000 |

| Creditors | -27,830 | -16,442 | -221,301 | 270,629 | 300,000 |

| Accruals and Deferred Income | 0 | 0 | 0 | 0 | 0 |

| Deferred Taxes & Provisions | 0 | 0 | 0 | 0 | 0 |

| Cash flow from operations | |||||

| Investing Activities | |||||

| capital expenditure | |||||

| Change in Investments | 0 | 0 | 0 | 0 | 0 |

| cash flow from investments | |||||

| Financing Activities | |||||

| Bank loans | 0 | 0 | 0 | 0 | 0 |

| Group/Directors Accounts | 0 | 0 | 0 | 0 | 0 |

| Other Short Term Loans | 0 | 0 | 0 | 0 | 0 |

| Long term loans | 0 | 0 | 0 | 0 | 0 |

| Hire Purchase and Lease Commitments | 0 | 0 | 0 | 0 | 0 |

| other long term liabilities | 0 | 0 | 0 | 0 | 0 |

| share issue | |||||

| interest | |||||

| cash flow from financing | |||||

| cash and cash equivalents | |||||

| cash | 0 | 0 | 0 | 0 | 0 |

| overdraft | 0 | 0 | 0 | 0 | 0 |

| change in cash | 0 | 0 | 0 | 0 | 0 |

P&L

June 2023turnover

976k

-4%

operating profit

26.2k

0%

gross margin

10.2%

-6.92%

turnover

Turnover, or revenue, is the amount of sales generated by a company within the financial year.

Balance Sheet

June 2023net assets

390.6k

+0.05%

total assets

395.7k

-0.02%

cash

0

0%

net assets

Total assets minus all liabilities

ligoniel homes ltd company details

company number

NI649690

Type

Private limited with Share Capital

industry

41202 - Construction of domestic buildings

incorporation date

December 2017

age

7

accounts

Micro-Entity Accounts

ultimate parent company

previous names

N/A

incorporated

UK

address

46 hill street, belfast, county antrim, BT1 2LB

last accounts submitted

June 2023

ligoniel homes ltd Charges & Mortgages

A charge, or mortgage, refers to the rights a company gives to a lender in return for a loan, often in the form of security given over business assets.

We did not find charges/mortgages relating to ligoniel homes ltd.

ligoniel homes ltd Companies House Filings - See Documents

| date | description | view/download |

|---|